J.P. Morgan Special: Dealmaker 2022 – Top M&A Deal of Amgen (Part 02)

Shots:

-

In the year 2022, Amgen was the top dealmaker, based on the total deal value, with 6 deals at a total announced value of ~$34.5B. Amgen has disclosed 5 out of the 6 deals leaving its BigHat Biosciences deal undisclosed

-

Amgen’s acquisition of Horizon Therapeutics for a value of ~$28.3B was the key contributor towards the total deal value gained by Amgen in the year 2022

-

Amgen was followed by Pfizer, Sanofi, and J&J among the top deal makers of the year. Our team at PharmaShots has compiled an insightful report by utilizing the data collected by DealForma for the Deal Maker of the Year 2022

Summary:

The year 2022 was another exceptional year for the field of dealmaking in the biopharma industry. As the world slowly progresses toward recovery from the major setbacks imposed by the COVID-19 pandemic, the biopharma sector has also recuperated to a certain extent. Thereby, dealmaking kept pace throughout 2022 to make up for the lost time.

PhramaShots has compiled a comprehensive report on the Dealmaker of the Year, 2022, by leveraging DealForma's ardent and continuous analysis of the major biopharma deals. The report was made based on two criteria, Part 1 based on the number of deals signed and Part 2 based on the total deal value of the deals signed. In 2022, Amgen ($34.5B), Pfizer ($24.9B), Sanofi ($22.8B), and Johnson & Johnson ($19.6B) were among the top dealmakers based on the total disclosed deal value generated. PharmaShots presents the top highlights from Amgen’s dealmaking in the year 2022.

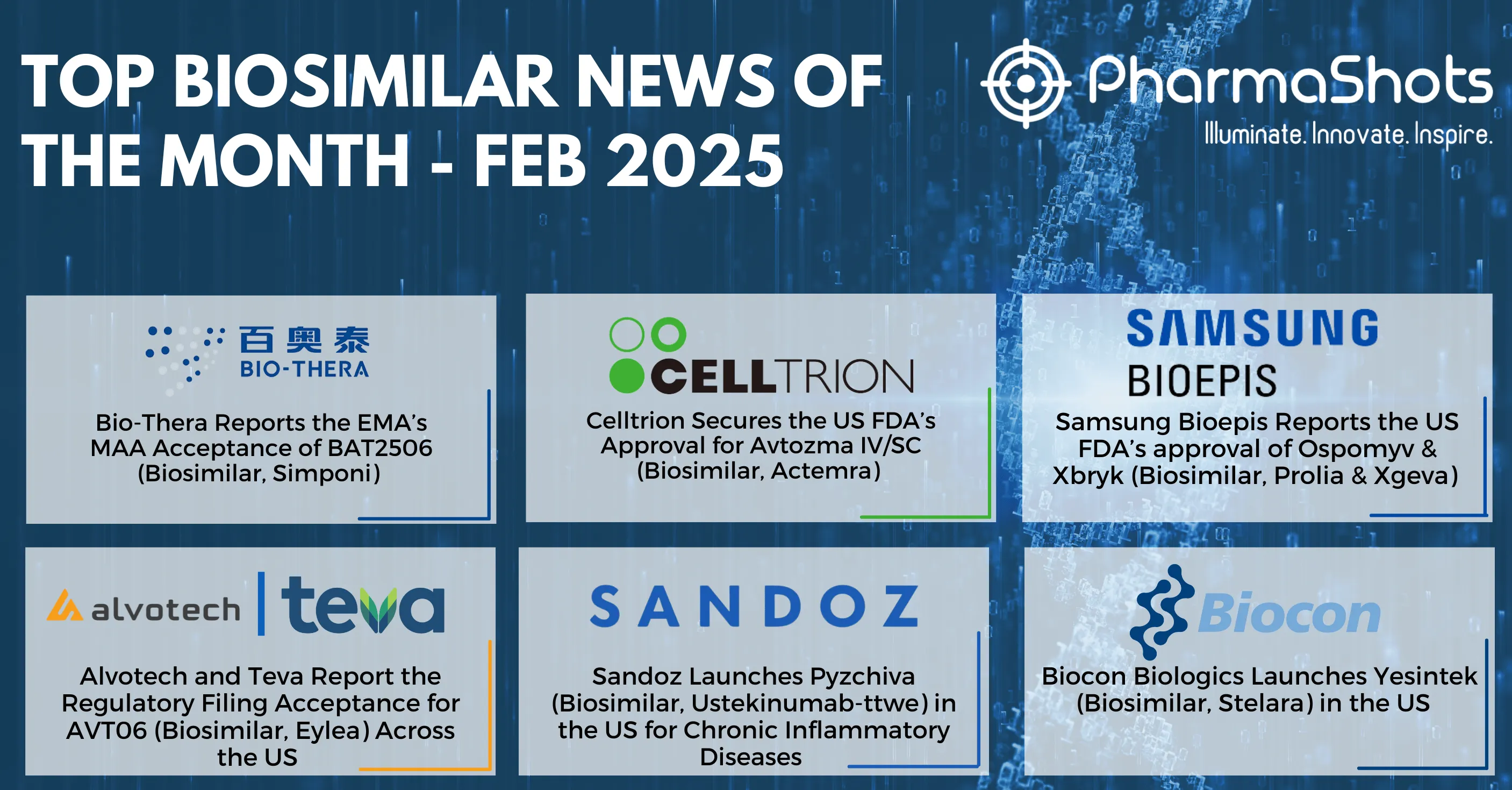

In 2022, Amgen underwent 6 transactions with major biopharma companies for deals including, acquisition (n=2), research collaborations (n=1), and development & commercialization licensing (n=3). The company has disclosed the values of 5 deals whereas the transaction value of its deal with BigHat Biosciences remains undisclosed. Amgen’s highest transaction was for the acquisition of Horizon Therapeutics for ~$28.3B. The number of deals signed by the company decreased by 50% in 2022 as it underwent a total of 12 deals in the year 2021. The disclosed deal value of Amgen in 2021 was ~$6.7B vs ~$34.5B in 2022. The huge difference in the numbers is a result of Amgen acquiring Horizon for ~$28.3B in 2022. Thereby, Amgen’s opulent deal with Horizon Therapeutics has bought the company to the top among other companies. Amgen is a biotechnology company that provides treatment options under therapeutic areas including, oncology, bone health, neuroscience, immunology, nephrology & inflammation.

Top Deals of Amgen

Amgen Acquired Horizon Therapeutics for $27.3B

-

Under the terms of the agreement, Horizon shareholders will receive $116.5/ share at a 19.7% 1-day premium on a fully diluted value of $27.3M. The acquisition implies nearly ~$28.3B as a total enterprise value

-

The transaction was made by Amgen with the aim to reinforce its product pipeline focused on the treatment of rare and immunological diseases by adding a complementary portfolio of products from Horizon

-

With this acquisition, Horizon’s lead assets Actimmune (granulomatous disease & osteopetrosis), Buphenyl (hyperammonaemia), Duexis (musculoskeletal pain & osteoarthritis), Uplizna (neuromyelitis optica, myasthenia gravis), and Tepezza (graves ophthalmopathy) will now be under Amgen’s umbrella

Source: https://www.pharmashots.com/press-releases/amgen-to-acquire-horizon-therapeutics-for-278bn

Amgen Acquired ChemoCentryx for $3.7B

-

Under the terms of the agreement, ChemoCentryx’s shareholders will receive $52.0/ share in cash at a premium of 116% which represents an enterprise value of $3.7B. Amgen completed this acquisition in Oct 2022

-

Amgen has acquired ChemoCentryx’s lead assets including Tavneos & Avacopan along with 3 early-stage products (CCX559, CCX507 & CCX587) targeting chemoattractant receptors in other inflammatory diseases & oral checkpoint inhibitor for cancer

-

In Oct 2021, the US FDA approved Tavneos, a selective complement component 5a receptor inhibitor, for the treatment of patients with severe active ANCA-associated vasculitis

Source: https://pharmashots.com/press-releases/amgen-to-acquire-chemocentryx-for-4-billion-in-cash

Related Post: Amgen to Acquire Chemocentryx for ~$4B

Amgen and Generate Enter into a Research Collaboration for the Development and Commercialization of Protein Therapeutics

-

Generate will receive $50M up front for the initial 5 programs at a transaction value of $1.9B, along with $370M in milestones plus royalties

-

On the other hand, Amgen will receive the worldwide rights to develop & commercialize 5 clinical targets against multiple therapeutic areas & protein modalities along with an option to select up to 5 additional programs at additional costs

-

The collaboration gives light to the combination of Amgen’s biologics drug discovery expertise with Generate’s AI platform which allows multi-specific drug designing & generating potential lead molecules with predictable manufacturability & clinical behaviour

Related Post: Amgen Entered into a Research Collaboration Agreement with Generate Biomedicines to Discover Protein Therapeutics

Amgen Enters into a Research Collaboration with Plexium to Advance its Targeted Protein Degradation Therapies

-

Through this transaction, Plexium is eligible to receive ≥$500M in pre-clinical, clinical, regulatory, and commercial milestones, plus royalties

-

The collaboration will initially focus on 2 programs for the treatment of cancer in which Amgen will have the option to add additional programs. Additionally, Amgen holds a commercial license to each program that advances to a predefined preclinical stage of development

-

The aim of the partnership is to expand targeted degradation opportunities through the discovery of previously unrecognized molecular glues or monovalent degraders by combining Plexium's targeted protein degradation platform with Amgen's early discovery expertise

Amgen Signs a Research Collaboration with Arrakis to Discover Novel RNA Degrader Small Molecule Therapeutics

-

Under the terms of the agreement, Arrakis will receive $75M upfront for 5 initial programs & is eligible to receive undisclosed preclinical, clinical, regulatory & sales milestones for each program plus royalties

-

Additionally, Arrakis also received an option to nominate additional programs at additional costs & upon exercising the option, will be eligible to receive "several billion dollars" in future milestones

-

The collaboration aims to design and engineer targeted RNA degraders by integrating the capabilities of Amgen & Arrakis’ innovative discovery platforms

Disclaimer:

-

PharmaShots has not included clinical trial agreements and older deals with only milestone payments in 2022

-

The overall deal value is higher than mentioned as Amgen has 1 undisclosed deal

Related Post: JP Morgan Special: Dealmaker 2022 – Top M&A Deal of Roche (Part 01)

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.